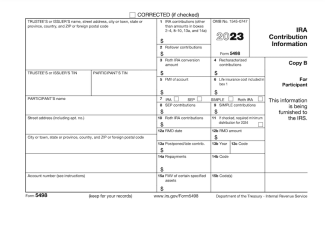

Form 5498 - What is it and Does it Affect My Individual Income Tax Return?

Form 5498, also known as the "IRA Contribution Information" form, is a crucial document for individuals who have retirement accounts in the United States. Issued by financial institutions and trustees, this form reports contributions, rollovers, conversions, and fair market values associated with various types of retirement plans. Let's delve into what Form 5498 entails, its importance, and how it impacts taxpayers.

What is Form 5498?

Form 5498 serves as an informational return that reports contributions made to individual retirement arrangements (IRAs), including Traditional, Roth, SEP (Simplified Employee Pension), and SIMPLE (Savings Incentive Match Plan for Employees) IRAs. It is filed by the trustee or issuer of the IRA to report the fair market value (FMV) of the account and contributions made during the tax year.

Key Components of Form 5498:

-

IRA Contributions: This section of the form reports the total amount contributed to your IRA during the tax year, including both deductible and non-deductible contributions. It also includes rollover contributions from other retirement plans.

-

Rollovers and Conversions: Form 5498 also captures any rollovers or conversions made within the tax year. A rollover refers to the movement of funds from one retirement account to another, typically without incurring taxes or penalties, provided certain conditions are met.

-

Fair Market Value (FMV): The form reports the FMV of your IRA as of the end of the tax year. This value is essential for determining required minimum distributions (RMDs) and for calculating taxable amounts when distributions are taken.

Why is Form 5498 Important?

-

Tax Compliance: The IRS uses Form 5498 to ensure taxpayers are accurately reporting their IRA transactions and complying with tax laws.

-

Verification of Contributions: Taxpayers use this form to verify IRA contributions they made during the tax year, ensuring they do not exceed annual contribution limits set by the IRS.

-

Tax Planning: It provides essential information for tax planning purposes, especially regarding deductions, conversions, and distributions from retirement accounts.

Who Receives Form 5498?

Generally, if you have an IRA account, your financial institution or trustee will issue Form 5498 to you and submit a copy to the IRS. Even if you did not make any contributions or take any distributions during the year, you may still receive this form to reflect the account's FMV.

Filing Requirements and Deadlines:

-

Issuance: Financial institutions must furnish Form 5498 to account holders by May 31st each year.

-

IRS Reporting: The issuer files a copy of Form 5498 with the IRS by June 30th, along with a Form 1096 summarizing all Forms 5498 filed.

Common Questions About Form 5498:

1. Do I Need to Attach Form 5498 to My Tax Return? No, you typically do not need to attach Form 5498 to your tax return. It is for informational purposes and helps you complete your tax return accurately.

2. What Should I Do If I Spot Errors on Form 5498? Contact your financial institution or trustee promptly to correct any errors. They can issue a corrected form if necessary.

3. How Does Form 5498 Impact My Taxes? While Form 5498 itself does not affect your tax liability, the information it contains informs your tax reporting, especially concerning deductions, contributions, and distributions from your IRA.

In conclusion, Form 5498 plays a vital role in the IRS's efforts to monitor retirement accounts and ensure compliance with tax regulations. As a taxpayer, understanding the information on this form can help you manage your retirement savings effectively and stay in good standing with the IRS. Always review this form carefully and consult with a tax advisor if you have any questions regarding its implications on your tax situation.