Business Mileage Documentation is Critical to Successful Audit Defense

A recent Tax Court case (Powell, TC Memo. 2016-111) reinforces the importance of keeping a detailed mileage log to support your business deductions. In this case, a taxpayer used his personal vehicle in his marketing business. He kept a detailed log with the exact miles driven, destination and purpose for some activities. For others, however, he either estimated his mileage or failed to list his business destination. The Tax Court approved the business miles for which he had comprehensive records and disallowed the rest.

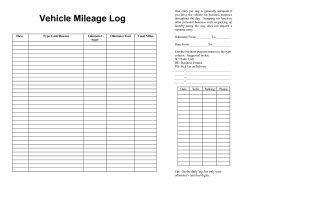

Remember, in an IRS audit the burden of proof falls on the taxpayer. According to IRS Publication 463, if you are deducting automobile mileage then you must keep records that show details of the following elements: the mileage for each business use, the date of the use of the car, your business destination and the business purpose for the expense.

To assist you in this area, please see the Business Recordkeeping Guide and Self-Employment Deductions Worksheet on our web site.